Pay after tax calculator

US Salary Tax Calculator Calculate Check how your salary compares to the cost of living in New York Take-Home Pay in the US Simply enter your annual or monthly income into the tax. Enter your info to see.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Make Your Payroll Effortless and Focus on What really Matters.

. Ad Compare Prices Find the Best Rates for Payroll Services. Over 900000 Businesses Utilize Our Fast Easy Payroll. Learn About Payroll Tax Systems.

Taxable income Tax rate Tax liability Step 5 Additional withholdings Once you have worked out your tax liability you minus the money you put aside for tax withholdings. Learn About Payroll Tax Systems. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

SARS Income Tax Calculator for 2023. Our salary calculator for Canada takes each of the four major tax expenses into account. The advantage of donating via this method is that you dont.

Where the taxable salary income exceeds Rs. Youll then get a breakdown of your. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

These are levied not only in the income of residents. This calculator will help to determine your paycheck amount after taxes and benefit deductions have been subtracted. Total Income After Tax Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income.

Create professional looking paystubs. Make Your Payroll Effortless and Focus on What really Matters. The Latest NHS pay scales with supporting salary calculation to illustration salary deductions PAYE NICs Pension and show take home paye after tax.

All Services Backed by Tax Guarantee. Sign Up Today And Join The Team. How much Australian income tax you should be paying what your take home salary will be when tax and the Medicare levy are removed your marginal tax rate This calculator can also be used.

This calculator is always up to date and conforms to official Australian Tax Office. Your average tax rate is. We use the most recent and accurate information.

Plug in the amount of money youd like to take home. Pennsylvania Paycheck Calculator - SmartAsset SmartAssets Pennsylvania paycheck calculator shows your hourly and salary income after federal state and local taxes. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

Church and chapel metal arts. Get Your Quote Today with SurePayroll. Your average tax rate is 1121 and your marginal.

Over 900000 Businesses Utilize Our Fast Easy Payroll. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Arkansas Income Tax Calculator 2021.

Ad Generate your paystubs online in a few steps and have them emailed to you right away. Your average tax rate is. That means that your net pay will be 40568 per year or 3381 per month.

You can use our Irish tax calculator to estimate your take-home salary after taxes. The Hourly Wage Calculator Dont know what your salary is just the hourly rate. 3500000 but does not exceed Rs.

Pay calculator Use this calculator to quickly estimate how much tax you will need to pay on your income. Payroll Giving is the system used to donate to registered charaties directly through your payroll provider at the time you get paid. 5000000 the rate of income tax is Rs.

It can also be used to help fill steps 3. If you make 65000 a year living in the region of Arkansas USA you will be taxed 10992. Federal tax which is the money youre paying to the Canadian government.

Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates. Just type in your gross salary select how frequently youre paid and then press Calculate. That means that your net pay will be 43041 per year or 3587 per month.

Ad Compare Prices Find the Best Rates for Payroll Services. Get Started Today with 1 Month Free. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Let The Hourly Wage Calculator do all the sums for you - after the tax calculations see the annual pay and. Ad Fast Easy Accurate Payroll Tax Systems With ADP. 370000 20 of the amount exceeding Rs.

Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Sign Up Today And Join The Team.

2021 2022 Income Tax Calculator Canada Wowa Ca

How To Calculate Income Tax In Excel

What Are Earnings After Tax Bdc Ca

How To Calculate Income Tax In Excel

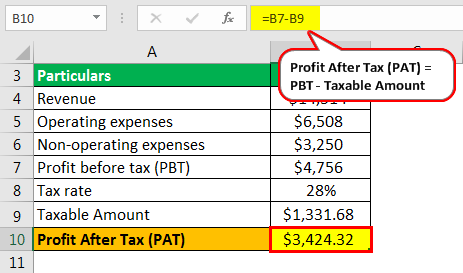

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

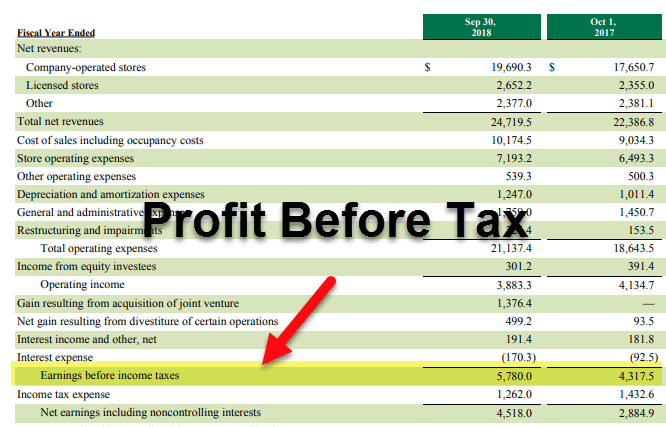

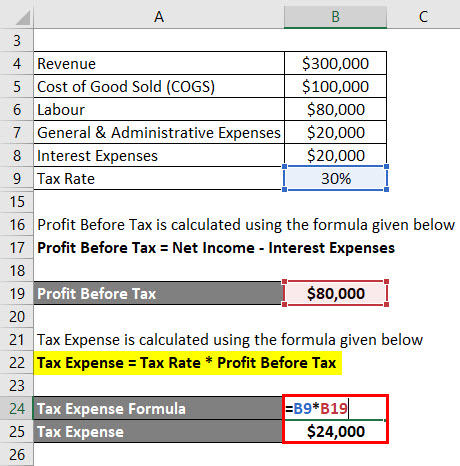

Profit Before Tax Formula Examples How To Calculate Pbt

How To Calculate Net Pay Step By Step Example

Provision For Income Tax Definition Formula Calculation Examples

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Nopat Formula How To Calculate Nopat Excel Template

Excel Formula Income Tax Bracket Calculation Exceljet

Ontario Income Tax Calculator Wowa Ca

How To Calculate Income Tax In Excel